Rural households in Africa and South Asia face significant a risk that weather-related disasters like severe drought and flood will destroy their agricultural livelihoods. In the wake of shocks, they are often forced to engage in costly coping strategies that compromise their ability to recover. The risk of shocks in itself creates hardship when households to forego investments in improved seeds or other ways to increase the size of their harvests.

Households with reliable and affordable tools to manage risk are more likely to be resilient to shocks. Today, these tools can be financial, such as agricultural index insurance, or agronomic, such as varieties that can withstand some drought and flooding. These tools can also be bundled together to increase the overall protection they provide and maximize a household's potential gains from adopting them.

There is an additional benefit possible when rural families know that they will be protected in the event of a shock. The added security can free them to make new investments to grow more food. Because of this, effective tools to manage risk can not only protect current well-being and promote resilience, but can provide a solid foundation for future improvements in well-being.

Together, resilience to shocks and the resulting investments into growing more food, build what we call Resilience+. The Resilience+ Innovation Facility is leveraging a decade of field evidence generate Resilience+ and accelerate efforts to sustainably strengthen food security and spur inclusive agricultural transformation.

Development Economics and Resilience+

Maize Farming in Mozambique and Tanzania

Small-scale maize farmers in East Africa face a high risk of drought that destroys their crops and livelihoods. Mozambique faces a risk of both severe drought and extreme weather that causes widespread flooding. Tanzania faces a high risk of drought that destroys crops and forces small-scale farmers to forego investments in higher productivity.

Development economics is a field of study that applies the analytical tools of economics and statistics to the challenges of economic and agricultural development, in particular in less-developed countries. Development economists gather evidence that helps policy makers and international donors make investments have have a positive impact on people's lives.

A generation of development economics research has produced an extensive literature on the impacts of risk in developing countries where a majority of households take part in agriculture. While conflict is increasingly a main driver of food insecurity, weather-related shocks are a perennial risk that severely hinders a rural household's ability to feed themselves. This risk is exacerbated by the impacts of climate change which has made weather-related disasters like drought and flood more frequent and more severe.

At the foundation of the concept of Resilience+ is a body of evidence that comes from theoretical and applied development economics research on the impacts of agricultural insurance for individual rural households, also known as microinsurance. Field trials have shown that microinsurance, if effective, can produce two kinds of critical impacts: "ex-ante" impacts and "ex-post" impacts in relation to a shock.

The case for microinsurance is based in large measure on its ex-post impacts, have to do with how microinsurance changes the way a household copes with a shock. Evaluations of the Index-based Livestock Insurance (IBLI) in Kenya, for example, have found that the insurance fundamentally changes coping strategies among pastoralist households whose livelihoods depend on livestock. For poorer households, IBLI reduces reliance on meal reduction as a post-shock coping strategy (Janzen and Carter, 2019). Another study found that insurance allowed cotton farmers to preserve their capital to plant again a year after a severe shock that otherwise would have forced them to sell off equipment and exit cotton production at least for the short-term (Stoeffler et al., 2021).

Several studies in other settings (see Hill et al., 2019 and Boucher et al., 2020) have found additional benefits beyond shifts in coping strategies that can have devastating long-term impacts. With microinsurance there are households who avoid decapitalization in the wake of shocks and also show higher rates of agricultural investment in the year following a shock and insurance payout compared to uninsured households.

These additional investments are an example of the ex-ante effects of microinsurance, which are the effects of microinsurance before a shock occurs. If a household expects to be able to cope with a disaster, they are more likely to take on productive investments they otherwise could not risk, such as improved seed varieties or costly agricultural inputs that can increase agricultural productivity and even income.

A handful of studies, most of them randomized controlled trials (RCTs) that by design establish the causal impacts of a program or intervention, have established that insurance can lead to substantial ex-ante increases in on-farm investment, usually in the range of 15-30% compared to uninsured households (see Cai, 2016; Elabed & Carter, 2016; Hill et al., 2019; Jensen et al., 2017; Karlan et al., 2014; Mobarak and Rosenzweig, 2014; and Stoeffler et al., 2021).

Existing Financial and Agronomic Tools to Manage Risk

Rice Farming in Bangladesh

Flood is a constant threat in many parts of Bangladesh where people’s livelihoods depend on a good rice crop. Flood disasters drive rural poverty by forcing families to safeguard themselves at a high cost and increasing the risk of making investments that could produce higher yields.

A handful of tools for managing weather-related risk are already available to rural households in developing countries, though many of them have yet to have a broad, transformative impact for all small-scale farmers.

Agricultural Index Insurance

Agricultural index insurance is a tool for risk management that has shown significant promise for promoting sustainable development and resilience. Agricultural index insurance bases payouts on an easy-to-measure index of factors, such as rainfall or average yields, that predict individual losses. Using an index to predict losses reduces costs compared to conventional insurance that relies on verified claims. Index insurance is attractive as a risk-management tool in developing countries where the fixed costs of verifying claims for a high number of small farms make conventional insurance too expensive.

However, effectively implementing agricultural index insurance has been complicated. Agricultural index insurance interventions require collaboration across multiple public- and private-sector partners. Markets have also struggled with expensive yet poor-quality contracts and inadequate consumer education, which are partly responsible for the resulting in low levels of adoption by individual farmers.

At the same time, agricultural index insurance has achieved broad support across the development community. International investments in research have significantly improved the indices and contract design ready for adoption by local insurance sectors seeking to advance more finely targeted, inclusive, higher-quality and better-integrated applications of microinsurance for comprehensive disaster risk management for rural families.

Savings Accounts

Small-scale farming households have long used informal savings to manage agricultural risk. However, this form of savings typically generate negative real rates of return for a variety of reasons that include the deterioration of stored commodities as well as what the literature often calls problems of self- control (Ashraf et al., 2006) and other control (Platteau, 2000).

In response, a number of NGOs have promoted a sort of semi-formal village based savings groups, typically referred to as Village Savings and Loan Associations (VSLAs) (Ashe and Neilan, 2014). While generalization about VSLAs is difficult, many groups include multiple named savings accounts, including one set aside to assist a saver in the event of shocks or extraordinary needs. Evaluation of VSLAs to date has been modest (Ksoll et al., 2016; Beaman et al., 2014; and Cassidy and Fafchamps, 2020). Studies have found some indication that they improve food security, but there is little evidence that VSLAs produce the kind of ex-ante investment response that has been documented in the case of microinsurance.

There have also been efforts to expand direct individual access to formal savings accounts by making such accounts cheaper, more available and paying higher interest on deposits. However, Prina (2015), for example, finds no consistent evidence that formal savings account have measurable economic effects. Like Prina, Carter et al. (2018) find that making savings accounts available with incentives to save leads to significant increases in total savings, both formal and informal. However the increases in savings do not spill over to neighbors.

This lack of spillovers may reflect that savings is by construction a flexible financial tool, meaning some may hold savings to buffer shocks while others use the cash to invest in agriculture. Others still may use it to exit agriculture entirely and undertake other economic activities.

In short, the literature on savings indicates that improved savings accounts are popular and seem to face ready demand. Untested is whether savings can be woven into a more comprehensive package that can underwrite resilience and Resilience+.

Contingent Lines of Credit

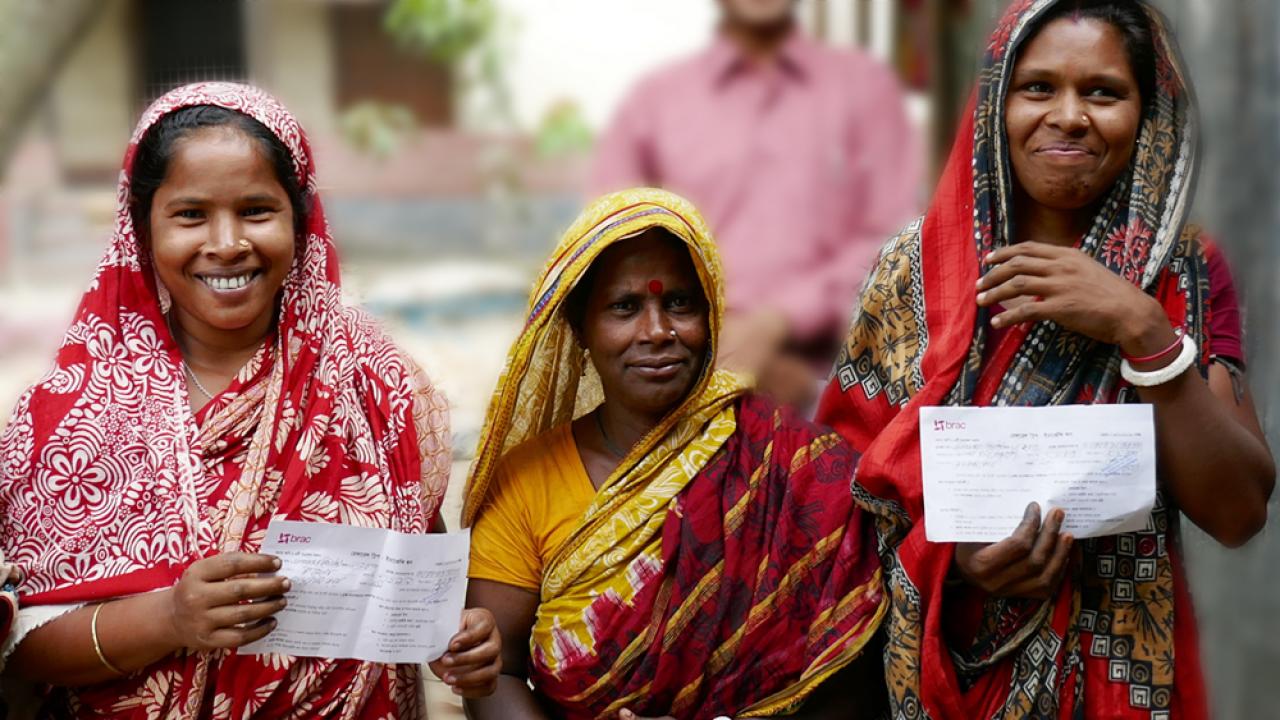

Lane (2020) is perhaps the only study that explores contingent lines of credit (CLOC) as an explicit risk management tool for small-scale farming households. In that study, the NGO BRAC in Bangladesh pre-qualified a number of borrowers with excellent repayment histories on conventional loans for emergency loans that would only be made available if a flood index was triggered. Drawing analogies to the microinsurance impact literature summarized above, Lane found that the CLOC program had substantial impact on ex-ante investment and may also have helped families smooth consumption after a shock. Both effects suggest that CLOCs are a promising avenue for generating Resilience+.

Stress-Tolerant Seed Varieties

Stress-tolerant seed varieties are among the newest technologies that potentially improve the resilience of smallholder farmers. These crop varieties have been specially bred to withstand weather-related shocks like drought or flood. Most notable of these are stress-tolerant maize varieties developed through the Drought-tolerant Maize for Africa project led by the International Maize and Wheat Improvement Center (CIMMYT) and flood-tolerant rice developed by the International Rice Research Institute (IRRI).

Encouraging evidence highlights the potential of these technologies. Emerick et al. (2016), for example, found that flood-tolerant rice varieties not only protected Indian farmers against the worst consequences of a shock, but also gave them confidence to intensify their investment in productivity-enhancing inputs. Boucher et al. (2021) found similar effects for drought-tolerant maize in Mozambique and Tanzania.

Stress-tolerant crop varieties are a particularly attractive innovation because of their very low marginal cost. While breeding these varieties demands substantial upfront investments in lab work and field trials, once varieties are developed they can be multiplied and distributed to farmers with little or no additional cost compared to other varieties.

This marginal-cost advantage is especially pronounced for smallholder farmers in developing countries since much of the fixed cost of developing these varieties is either covered by public research entities like CGIAR research institutes, often with support from private firms that intend to recoup the cost of their investment in more lucrative markets.

Despite the low marginal costs of producing stress-tolerant seeds, they offer farmers protection against only a limited range of the shocks that they confront. The flood tolerant rice variety studied by Emerick et al. (2016) provides protection against flood events that last no more than 15 days (Dar et al., 2013), but succumbs like other rice varieties to longer periods of flooding. In the year of the Emerick et al. (2016) impact evaluation, some study farmers experienced floods which fortunately lasted only 14 days. Had the flood waters not receded at that time, the results of the study would likely have been quite different.

Similarly, the drought-tolerant maize varieties studied by Boucher et al. (2021) protect against mid-season drought, but remain vulnerable to early and late season drought in addition to the other biotic and abiotic stresses that afflict other maize varieties. This limited or single peril protection reflects the fact that plant breeders face biological constraints that limit how much and what types of stress these new varieties can withstand.

The narrow single-peril protection offered by stress-tolerant seeds also raises an adoption dilemma for smallholder farmers, especially those who would normally re-use their own saved seed to avoid purchasing new seeds. It is not obvious that stress-tolerant seeds alone are an adequate foundation for farmers to increase their investments that would generate Resilience+.

However, the evidence on these varieties does raise the intriguing possibility that financial instruments like index insurance could be designed to pick up where the stress-tolerant traits leave off. Bundling with such an instrument could provide smallholder farmers more comprehensive risk mitigation and more effectively reduce the welfare burden of uninsured risk.

The Future of Resilience+ Innovation

Cotton Farming in Burkina Faso and Mali

When the rains are good in West Africa, cotton crops thrive. In those years, cotton farmers reap the rewards of a higher-risk cash crop and the local cotton company has more to sell. When drought strikes and cotton crops fail, farmers might have to sell off everything they own to pay back input loans. The alternative is to quit cotton entirely, a loss both for them and the local economy.

Long-term Impacts of Promising Tools to Manage Risk

In large part due to the funding cycles and accountability of donors and NGOs, it is typically infeasible to fund long-term research that allows for far downstream confirmation of expected impacts, such as health, nutrition, loan access, credit supply, interest rates, rates of transient poverty, etc. This is limitation is further exacerbated when testing tools like insurance that by design only rarely demonstrate their true value. Donor expectations for more timely results can lead to a project ending long before payouts even occur.

Consistent, Comprehensive & Inclusive Metrics on Resilience+

There are consistently emerging approaches to measurements of success and resilience from researchers (e.g., see Cissé and Barrett, 2018 and their review of approaches used by WFP, USAID and other donors). There is a need for a consistent, long-term, durable metric for progress and success. If the sector strives for comprehensive disaster risk management, the metrics must also reflect comprehensive measures of success. An objective measure for Resilience+ can track how households increase investments and improve their level of well-being over what it would have been absent better tools for managing their disaster risk. Having such a measure will make longer term evaluations more consistent and useful.

Flexible Tools for the Inclusive Agricultural Transformation Lifecycle

More research is needed on how to effectively integrate a variety of disaster risk management tools – including financial, agronomic, and others – cohesively in a way that allows households to create a risk management portfolio that can evolve and change with their own needs and abilities. While there is nascent work on combining insurance and stress-tolerant seeds, incorporating other financial instruments like contingent lines of credit (Lane, 2020) has yet to be undertaken on a large scale.

For further reading

Ashe, Jeffrey & Kyal Jagger Neilan (2014). In Their Own Hands: How Savings Groups Are Revolutionizing Development.

Ashrah, N., D. Karlan, and W. Yin. (2006). “Tying Odysseus to the Mast: Evidence from a Commitment Savings Product in the Philippines,” Quar. J. Econ. 121 (2), 635–672.

Banerjee, A., Duflo, E., Goldberg, N., Karlan, D., Osei, R., Parienté, W., Shapiro, J., Thuysbaert, B. & Udry, C. (2015). "A multifaceted program causes lasting progress for the very poor: Evidence from six countries." Science, 348(6236), 1260799.

Beaman, L.A., Karlan, D., Thuysbaert, B. (2014). “Saving for a (not so) rainy day: A Randomized Evaluation of Savings Groups in Mali,” vol. 1043. Yale University Economic Growth Center Discussion Paper.

Boucher, S.R., M.R. Carter, T. Lybbert, P. Marenya, J. Malacarne, L. Paul (2019). “Innovations for Resilience Two ways in Mozambique and Tanzania.” MRR Innovation Lab Evidence Insight 2019-02.

Boucher, S.R., M.R. Carter, T. Lybbert, P. Marenya, J. Malacarne, L. Paul (2021). “Bundling Stress Tolerant Seeds and Insurance for More Resilient and Productive Small-scale Agriculture,” NBER Working Paper.

Brune, Lasse, Xavier Gine, Jessica Goldberg & Deab Yang (2016). “Facilitating Savings for Agriculture: Field Experimental Evidence from Malawi,” Economic Development and Cultural Change 64(2): 187-220.

Breza, E., D. Osgood, B. Paul and C. Roenen (2016). A Quasi-experimental “post mortem” study of a discontinued insurance product in Haiti. https://basis.ucdavis.edu/sites/g/files/dgvnsk466/files/2017- 01/Revised-Scope-of-Work-BASIS-FINAL%20%281%29.pdf

Cai, Jing, Alain De Janvry, and Elisabeth Sadoulet. 2015. "Social Networks and the Decision to Insure." American Economic Journal: Applied Economics, 7 (2): 81-108.

Cai, Jing and Changcheng Song. (2017). “Do Disaster Experiences and Knowledge Affect Insurance Take- up?” Journal of Dev Economics, 124: 83-94.

Carter, Michael R., Stephen Boucher and Elizabeth Long (2011). “Public-Private Partnership for Agricultural Risk Management through Risk Layering,” I4 Index Insurance Innovation Initiative Brief 2011-01.

Carter, Michael R., Lan Cheng and Alexander Sarris (2016). “Where and How Index Insurance Can Boost the Adoption of Improved Agricultural Technologies,” Journal of Development Economics 118:59-71.

Carter, Michael, Alain de Janvry, Elisabeth Sadoulet, and Alexandros Sarris. 2017. “Index Insurance for Developing Country Agriculture: A Reassessment.” Annual Review of Resource Economics, 9: 421-38.

Carter, M. R. and Sarah Janzen (2017). “Social Protection in the Face of Climate Change: Targeting Principles and Financing Mechanisms,” Environment and Development Economics.

Carter, M.R., R. Laajaj and D. Yang (2018). “Directed vs. Ennablien Interventions: A Study of Subsidies and Savings in Rural Mozambique,” unpublished.

Carter, Michael and Tara Steinmetz (2018). “Quality Standards for Agricultural Index Insurance: An Agenda for Action,” in State of Microfinance, MunichRE.

Carter, M.R., Rachid Laajaj and Dean Yang (forthcoming). “Temporary Subsidies and Green Revolution Technology Adoption by Farmers and Their Social Networks,” American Economic Journal: Applied Economics.

Carter, M.R. (2020). “Generating Resilience+ to Reduce Poverty and Spur Agricultural Growth,” MRR Innovation Lab Insight 2020-01.

Casaburi, Lorenzo and Rocco Macchiavello (2019). "Demand and Supply of Infrequent Payments as a Commitment Device: Evidence from Kenya." American Economic Review, 109.2 (2019): 523-555.

Cassidy, Rachael & Marcel Fafchampes (2020). “Banker my neighbour: Matching and financial intermediation in. savings groups,” Journal of Development Economics 125.

Ceballos, Kramer and Robles. (2019). “The feasibility of picture-based insurance (PBI): Smartphone pictures for affordable crop insurance.” Development Engineering, Volume 4, 2019, 100042.

Cissé, Jenn and C.B. Barrett (2018). Estimating development resilience: A conditional moments-based approach,” Journal of Development Economics, 135.

Chantarat, S., Mude, A. G., Barrett, C. B., & Turvey, C. G. (2017). Welfare impacts of index insurance in the presence of a poverty trap. World Development, 94, 119– 138. https://doi.org/10.1016/j.worlddev.2016.12.044

Dar, Manzoor H, Alain De Janvry, Kyle Emerick, David Raitzer, and Elisabeth Sadoulet (2013). “Flood- tolerant rice reduces yield variability and raises expected yield, differentially benefitting socially disadvantaged groups,” Scientific reports, 2013, 3, 3315.

Dupas, Pasculine and Jonathan Robinson (2013). “Why Don’t the Poor Save Mor? Evidence from Health Savings Experiments,” American Economic Review 104(4): 1138-1171.

Fisher, E.; Hellin, J.J.; Greatrex, H.; Jensen, N. (2019). “Index insurance and climate risk management: addressing social equity.” Development Policy Review, 37 (5) DOI: 10.1111/dpr.12387 Wiley.

Ghosh, Ranjan Kumar, Shweta Gupta, Vartika Sing, and Patrick S. Ward (2020). “Demand for crop insurance developing countries: New evidence from India,” accepted for publication in Journal of Agricultural Economics.

Giné X, Yang D. 2009. Insurance, credit, and technology adoption: field experiment evidence from Malawi. J. Dev. Econ. 89:1–11.

Giné, X., Karlan, D., & Ngatia, M. (2014). “Social networks, financial literacy and index insurance.” In M. Lundberg, & F. Mulaj (Eds.), Enhancing financial capability and behaviour in low- and middle-income countries (pp. 195– 208). Washington: World Bank.

Hobbs, Andrew (2019). “Insuring what matters most Intrahousehold risk sharing and the benefits of insurance for women.” University of California Davis, Job Market Paper. https://hobbservations.com/JMP.pdf

Ikegami, M., M.R. Carter, C.B. Barrett, and S. Janzen (2019). ”Poverty Traps and the Social Protection Paradox,” in C. Barrett, M.R. Carter and J.-P. Chavas (eds) The Economics of Poverty Traps (University of Chicago Press & NBER).

Janzen, S. and M.R. Carter (2019). “After the Drought: The Impact of Microinsurance on Consumption Smoothing and Asset Protection,” American Journal of Agricultural Economics.

Janzen, Sarah, Nicholas Magnan, Conner Mullally, I. Bailey Balmer, Soye Shin, Judith Odoul, and Karl Hughes. “Can Experimental Games and Improved Risk Coverage Raise Demand for Index Insurance? Evidence from Kenya." Forthcoming, American Journal of Agricultural Economics.

Jensen, N. D. & C. B. Barrett (2017). “Agricultural Index Insurance for Development.” Applied Economic Perspectives and Policy, 39.2, pp. 199{219.

Jensen, N., C. Barrett and A. Mude (2017). Cash Transfers and Index Insurance: A Comparative Impact Analysis from Northern Kenya.” Journal of Dev Econ, 129:14-28.

Jenson, N. , A. Mude, A. Vrieling, C. Atzberger, F., M. R. Carter, M. Meroni and Q. Stoeffler (2019). “Does the design matter? Comparing satellite-based indices for insuring pastoralists against drought,” Ecological Economics.

Johnson, Leigh, Brenda Wandera, Nathan Jensen & Rupsha Banerjee (2019) Competing Expectations in an Index-Based Livestock Insurance Project, The Journal of Development Studies, 55:6, 1221-1239, DOI: 10.1080/00220388.2018.1453603

Karlan D, Osei R, Osei-Akoto I, Udry C. 2014. Agricultural decisions after relaxing credit and risk constraints. Q. J. Econ. 129(2):597–652

Kazianga, H and Z Wahhaj (2020). “Will urban migrants formally insure their rural relatives? Family networks and rainfall index insurance in Burkina Faso.” World Development, 128, 104764.

Ksoll, C., Lilleør, H.B., Lønborg, J.H., Rasmussen, O.D. (2016). “Impact of village savings and loan Associations: evidence from a cluster randomized trial,” J. Dev. Econ. 120, 70–85.

Lane, Gregory. 2020. Credit Lines as Insurance: Evidence from Bangladesh. Working Paper, American University.

Lybbert, Travis J. and Adrian Bell. 2010. “Stochastic Benefit Streams, Learning and Technology Diffusion: Why Drought Tolerance is not the new Bt” AgBioForum 13(1): 13-24.

Lybbert, Travis and Michael R. Carter (2015). "Bundling Drought Tolerance and Index Insurance to Reduce Rural Household Vulnerability to Drought," in Risk, Resources and Development: Foundations of Public Policy (Elsevier Press).

Lybbert, T. C. B. Barrett, S. Boucher, M. R. Carter, S. Chantarat, F. Galarza, J. McPeak, and A. Mude (2010) “Dynamic Field Experiments in Development Economics: Risk Valuation in Morocco, Kenya, and Peru,” Agricultural and Resource Economics Review 39(2):176-192.

McIntosh, Craig, S. Ahmed and A. Sarris (2020). “The Impact of Commercial Rainfall Index Insurance: Experimental Evidence from Ethiopia,” American Journal of Agricultural Economics.

Miranda, M. et al. (forthcoming). Impact of Index-Insured Loans on Access to Credit: An Experimental Study in Northern Ghana. American Journal of Agricultural Economics.

Mishra, Khushbu. 2018. “You are Approved! Insured Loans Improve Credit Access and Technology Adoption of Ghanaian Farmers.” Paper presented to the International Conference of Agricultural Economists.

Mobarak, Ahmed Mushfiq, & Rosenzweig, Mark R. 2012. Selling formal insurance to the informally insured.

Morsink, Karlijn and Clarke, Daniel and Mapfumo, Shadreck, How to Measure Whether Index Insurance Provides Reliable Protection (July 18, 2016). World Bank Policy Research Working Paper No. 7744, Available at SSRN: https://ssrn.com/abstract=2811392

Platteau, J. (2000). “Egalitarian Norms and Economic Growth,” in J. Platteau, ed., Institutions, Social Norms, and Economic Development, Harwood, 2000, pp. 189–240.

Prina, Silivia (2015). “Bankign the poor via savings accounts: Evidence from a field Experiment,” Journal of Development Economics 115:16-31.

Quisumbing, Agnes, N. Kumar and J. Behrman (2018). “Do Shocks affect men’s and women’s assets differently? Evidence from Bangladesh and Uganda,” Development Policy Review 36:3-34.

Shirsath, Paresh, ShalikaVyas, PramodAggarwal and Kolli N.Rao (2019). “Designing weather index insurance of crops for the increased satisfaction of farmers, industry and the government.” Climate Risk Management, Volume 25, 2019, 100189.

Steinmetz T, Carter M. 2016. Village Insurance-Savings Accounts (VISAs). Rep., Feed Future, Washington, DC. http://basis.ucdavis.edu/wp-content/uploads/2017/01/VISA-Model.pdf

Stoeffler, Q., Carter, M., Guirkinger, C., & Gelade, W. (2021). “The spillover impact of index insurance on agricultural investment by cotton farmers in Burkina Faso.” World Bank Economic Review.

Syll, Mame Mor Anta and Weingärtner, Lena, Bundling Weather Index-Based Crop Insurance and Credit: A Cautionary Tale Against Misunderstood and Misinformed Take-Up (December 19, 2019). Available at SSRN: https://ssrn.com/abstract=3507421 or http://dx.doi.org/10.2139/ssrn.3507421

Takahashi, K, Y Noritomo, M Ikegami and ND Jensen (2020). “Understanding pastoralists’ dynamic insurance uptake decisions: Evidence from four-year panel data in Ethiopia.” Food Policy, 101910.

Vasilaky, Kathryn, Rahel Diro, Michael Norton, Geoff McCarney & Daniel Osgood (2020). “Can Education Unlock Scale? The Demand Impact of Educational Games on a Large-Scale Unsubsidised Index Insurance Programme in Ethiopia.” The Journal of Development Studies, 56:2, 361-282. DOI: 10.1080/00220388.2018.1554207

Ward, Makhija and Spielman 2019 https://onlinelibrary.wiley.com/doi/full/10.1111/1467-8489.12342

Ward, Patrick S. & Makhija, Simrin, 2018. "New modalities for managing drought risk in rainfed agriculture: Evidence from a discrete choice experiment in Odisha, India," World Development, Elsevier, vol. 107(C), pages 163-175.

Ward, PS, DL Ortega, DJ Spielman, N Kumar and S Minocha (2019). “Demand for complementary financial and technological tools for managing drought risk.” Economic Development and Cultural Change 68 (2), 607-653.

Wong, Ho Lun, Xiandong Wei, Haftom Bayray Kahsay, Zenebe Gebreegziabher, Cornelis Gardebroek, Daniel E. Osgood and Rahel Diro (2020). “Effects of input vouchers and rainfall insurance on agricultural production and household welfare: Experimental evidence from northern Ethiopia.” World Development, 135, 105074.