An agricultural index insurance contract’s quality is hidden. On its surface, farmers considering a policy or national governments seeking to subsidize coverage have no way to know whether a product has the potential to provide real value.

The Minimum Quality Standard (MQS) for agricultural index insurance is a simple, objective metric using standard economic and statistical tools. If an index insurance contract at a minimum has the potential to provide more value than no insurance at all or an equivalent cash transfer, it passes MQS.

The Minimum Quality Standard (MQS) for agricultural index insurance is a simple, objective metric using standard economic and statistical tools. If an index insurance contract at a minimum has the potential to provide more value than no insurance at all or an equivalent cash transfer, it passes MQS.

The MQS spreadsheet tool takes data on farm-level yields and insurance payouts, the price of the insurance contract and an estimate of off-farm income and calculates whether that contract meets MQS. It is also possible to use the tool to test potential products before they enter the market.

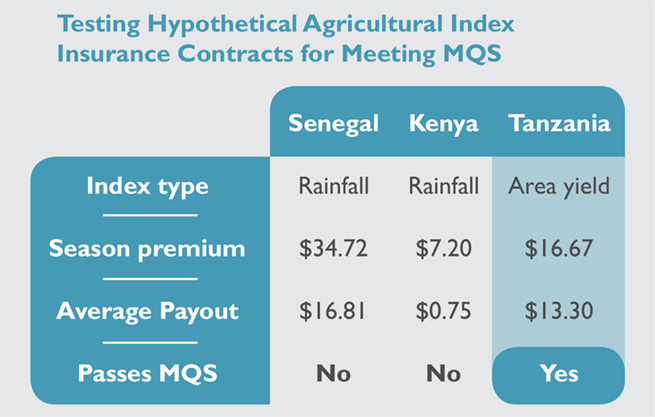

To illustrate how MQS works, we created three hypothetical datasets for contracts in Senegal, Kenya and Tanzania. While two of the three contracts fail MQS, each can be improved to provide greater value to farmers.

Senegal

In this hypothetical dataset, the product sometimes provides a positive return, but not at the time when it is most needed. In other words, it’s just another risky asset that doesn’t do much to reduce the risk facing the farmer. The price is also somewhat high – nearly twice the average payout, but even reducing the price of the average payout will not lead it to pass MQS.

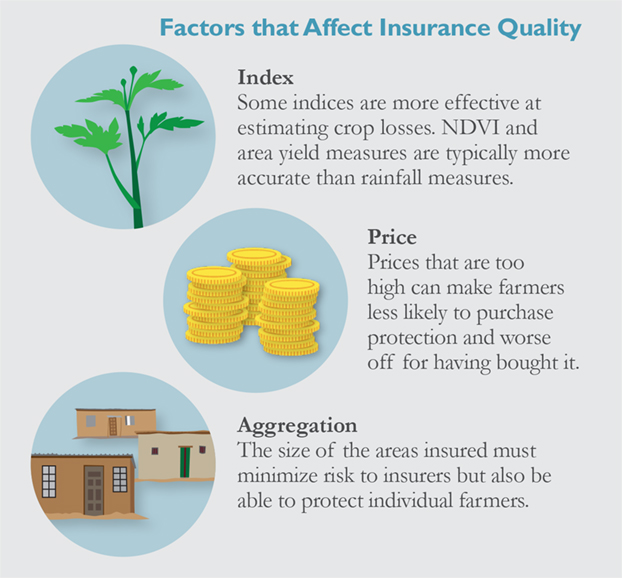

Instead, the product fails MQS because its rainfall index does not track farmer losses accurately enough. Any time an index does not accurately estimate losses, it is unlikely to meet MQS. Insurance is only useful if it pays when losses are actually experienced.

Using a more accurate index could potentially work. An area-yield index is an index based on average losses in a region measured directly. Though in practice, using an area yield contract can be expensive, which could drive up the cost of premiums to the point that the contract could still fail MQS.

Kenya

The hypothetical Kenya dataset failed for a different reason: the price is far too high. The product almost always pays less than it costs, so either there were no bad years in the dataset or the insurance company is taking far too large a cut. The contract could pass MQS, however, if the price of premiums were reduced by 90 percent.

Failure on price generally means one of two things. First, the insurance company has simply priced the contract too high. It may also be the data are from unusually good years, excluding the benefit of the insurance in a bad year when it is intended to be used. This problem might be solved by evaluating the index over a longer period.

Tanzania

The hypothetical product from Tanzania passed MQS because it is fairly priced and the index correlates well with farmers’ losses. The key here is that good contract design and good index design combined to create a useful product.

If a product does pass MQS, that means it might be a good investment for the average farmer. It does not, however, mean that the product is perfect. MQS is a measure of minimum quality, not of overall quality. Improving the index or lowering the price will still make products more beneficial.

Improving an Index Insurance Product above Minimum Quality

A first step is to figure out why a contract failed. Is the index poorly correlated with losses, or is the index area too large? Is the price too high? The MQS tool allows you to adjust the price to see how it might affect the results. You could also try different contract designs and input their payouts into the tool to see if they fare better.

The MQS tool establishes whether a product meets a minimum level of quality based on the idea that the insurance should be a good investment on average for a somewhat risk-averse farmer. When the price is too high or the index doesn’t track losses well, insurance is not a good investment, so it doesn’t pass the test.

When a product doesn’t pass MQS, it means that based on the information input into the tool it’s unlikely to benefit the average farmer who buys it. The result will be biased if, for example, the period for which data is input is unusually good for farmers. If a product fails, the data itself may not be sufficient to represent a reasonable range of outcomes.