Since 2006, the International Maize and Wheat Improvement Center (CIMMYT) and the International Institute for Tropical Agriculture (IITA) have developed drought-tolerant maize (DTM) varieties to address a widespread risk of drought in Sub-Saharan Africa. From 2014-2018, MRR Innovation Lab researchers partnered with CIMMYT on a randomized controlled trial (RCT) spanning Mozambique and Tanzania to test the impacts of bundling an innovative type of insurance with DTM to expand drought protection for small-scale farming families.

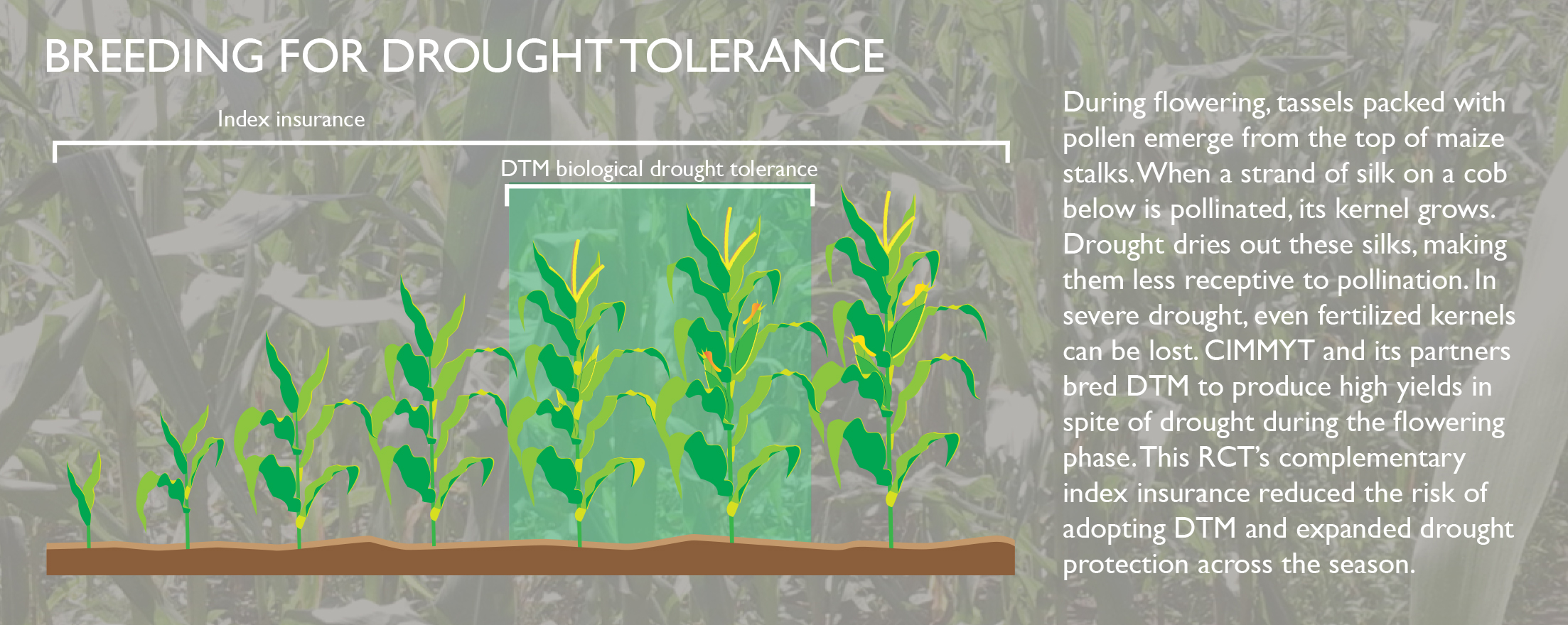

The intervention leveraged the complementary features of the two technologies, one agronomic and the other financial. The drought tolerance of the DTM seeds lowered the cost of the insurance. The insurance, which provided seed replacements in the event of severe drought, reduced the risk of adopting DTM seeds.

For the RCT, we divided our sample of 3,004 farm households into three groups. DT-group farmers were offered DTM seeds. DTII-group farmers were offered DTM seeds bundled with the insurance. A control group was offered neither. The insurance, which added 20 percent to the cost of the DTM seeds, replaced seeds in the season following severe droughts if estimated yield losses reached 40 percent.

Farmers in our sample all managed small, rainfed plots exposed to moderate to high drought risk. We collected yearly data after maize harvest from 2016-18. Seed and insurance marketing took place in partnership with five local seed companies and two local insurance companies prior to planting for the 2016-17 and 2017-18 seasons.

Participating households

Mozambique:1,237 | Tanzania: 1,767 | Total: 3,004

Experimental groups

DT group: Offered only DTM seeds

DTII group: Offered DTM seeds bundled with the index insurance for seed replacement after severe drought

Control group: Farmers offered neither

Funding (USAID)

$2,250,000

Implementation Partners

Hollard Insurance, IFFA Seed, Klein Karoo (K2), Meru Agro, Mozambique Ministry of Agriculture, Phoenix Seed Company, Suba Agro, Tanzanian Agricultural Research Institutes (ARI), Tanzania District Agriculture and Irrigation Commissions (DAICO), UAP Insurance

Impacts summary

In the event of drought during mid-season, DTM sustained yields compared to other varieties. Following a severe drought, farmers who purchased seeds bundled with the index insurance for seed replacement more than recovered their yields in the following season. In years with no drought, DTM yields were higher than other varieties.

Impacts

- For farmers without drought-tolerant maize (DTM), yields fall by 15% after a mid-season drought, with higher food insecurity in the following year.

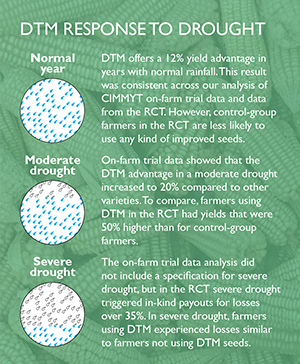

- DTM seeds offer a modest 12% yield advantage in normal years and insulate farmers against the negative consequences of mid-season drought.

- Without DTM, yields decline by 40% and food insecurity jumps by 45% following a severe drought not attributable to low mid-season rainfall.

- While DTM seeds do not insulate farmers against severe shocks, farmers with DTM seeds resiliently bounce back from a severe shock. This is especially true for farmers with insured seeds.

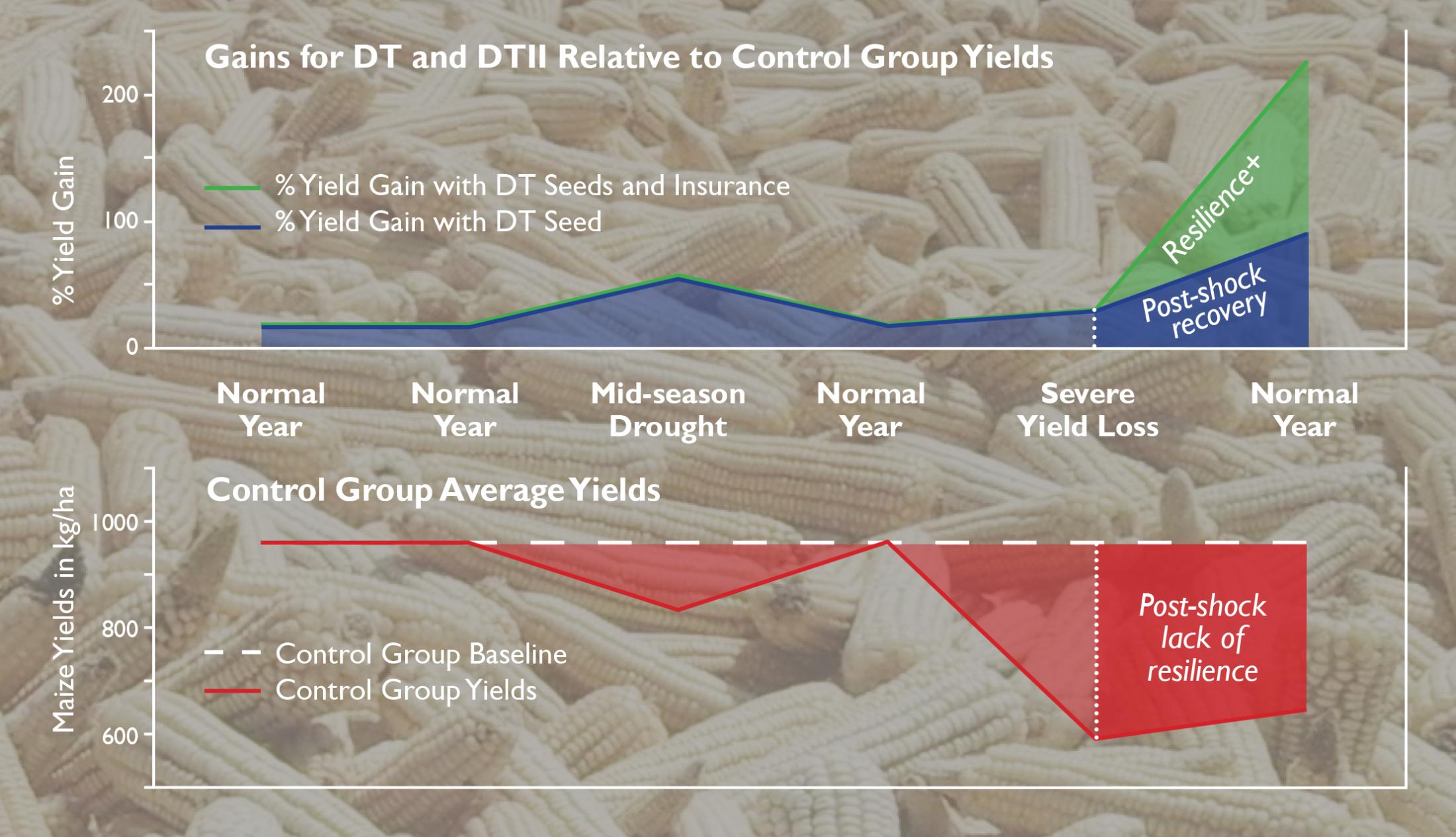

The figure below uses econometric results from the RCT data to illustrate how DTM and bundled index insurance impacted yields. The sequence of years ranges from normal rainfall to severe drought. Yield gains for the DT- and DTII-group farmers are relative to control-group yields for the type of year shown.

In normal years, DTM seeds increased yields by about 12 percent. In years with mid-season drought, DTM yields were nearly 50 percent higher, almost completely offsetting the losses experienced by farmers who were not offered either DTM seeds or DTM seeds with insurance. While the evidence is less precise, DTM seeds also appear to offset increases in food insecurity induced by mid-season droughts.

In years of severe drought, DTM yields also fell precipitously. But, as Figure 1 shows, in the wake of these severe shocks, farmers with insured seeds more than fully recovered from the prior season’s shock and even achieved higher yields. This indicates that the in-kind insurance payouts encouraged farmers to deepen their investments in maize production. While control-group farmers were generally able to recover from moderate shocks, they were unable to recover from severe shocks.

DTM and Drought

DTM was bred in controlled environments with full irrigation at the beginning of the season but withheld immediately before and during pollination.[1] This resulted in varieties with greater synchronization of tasseling and silking, which improves pollination and yields during a mid-season drought. When tested in drought-prone locations, with irrigation supplied only at planting and emergence, DTM showed transformative promise with yields as high as 137 percent over commercial comparison varieties.[2]

However, the average small-scale farmer grows crops in very different conditions, with little or no irrigation and a risk of drought at any time throughout the growing season. CIMMYT on-farm trials are a step removed from the controlled conditions of a variety’s development, though farmers in these trials tend to work more acreage with more resources than the average small-scale farmer. Even so, these trials provide a useful basis for estimating DTM’s yield benefits in the field.

However, the average small-scale farmer grows crops in very different conditions, with little or no irrigation and a risk of drought at any time throughout the growing season. CIMMYT on-farm trials are a step removed from the controlled conditions of a variety’s development, though farmers in these trials tend to work more acreage with more resources than the average small-scale farmer. Even so, these trials provide a useful basis for estimating DTM’s yield benefits in the field.

Comparing 2011-2016 DTM on-farm trial yields matched with historical geocoded data on rainfall and temperature, DTM shows higher yields overall than other improved varieties, and its yield advantage increased with drought. With average rainfall, DTM yielded nearly 12 percent more. In years with lower than average rain, the yield advantage increased to about 20 percent. This yield advantage is concentrated when drought comes in the middle of the season, consistent with how DTM was bred. Drought early in the season completely wiped out the DTM advantage.

We also found evidence that farmers who have the best soil, optimal altitude and most effective practices gain the biggest yield advantages from DTM. This raises the question of whether the protective benefits of DTM extend to the average small-scale farmer who contends with all the challenges of working in rain-fed agriculture.

[1] Zaman-Allah, M. et al. 2016. “Phenotyping for abiotic stress tolerance in maize: drought stress.” CIMMYT Feld Manual.

[2] Fisher, M., et al. 2015. “Drought tolerant maize for farmer adaptation to drought in sub-saharan Africa: Determinants of adoption in eastern and southern Africa.” Climatic Change.

Insuring Seeds

Agricultural index insurance is proving to be a valuable tool to transfer some of the risk out of small-scale farming in developing economies and to keep agricultural production from collapsing after a severe losses.

Rather than base payouts on verified losses, like conventional insurance, index insurance bases payouts on an easy-to-measure index of factors, such as rainfall or average yields, that predict individual losses. Index insurance is particularly attractive as a risk-management tool in developing countries where the fixed costs of verifying claims for a high number of small farms make conventional insurance expensive.

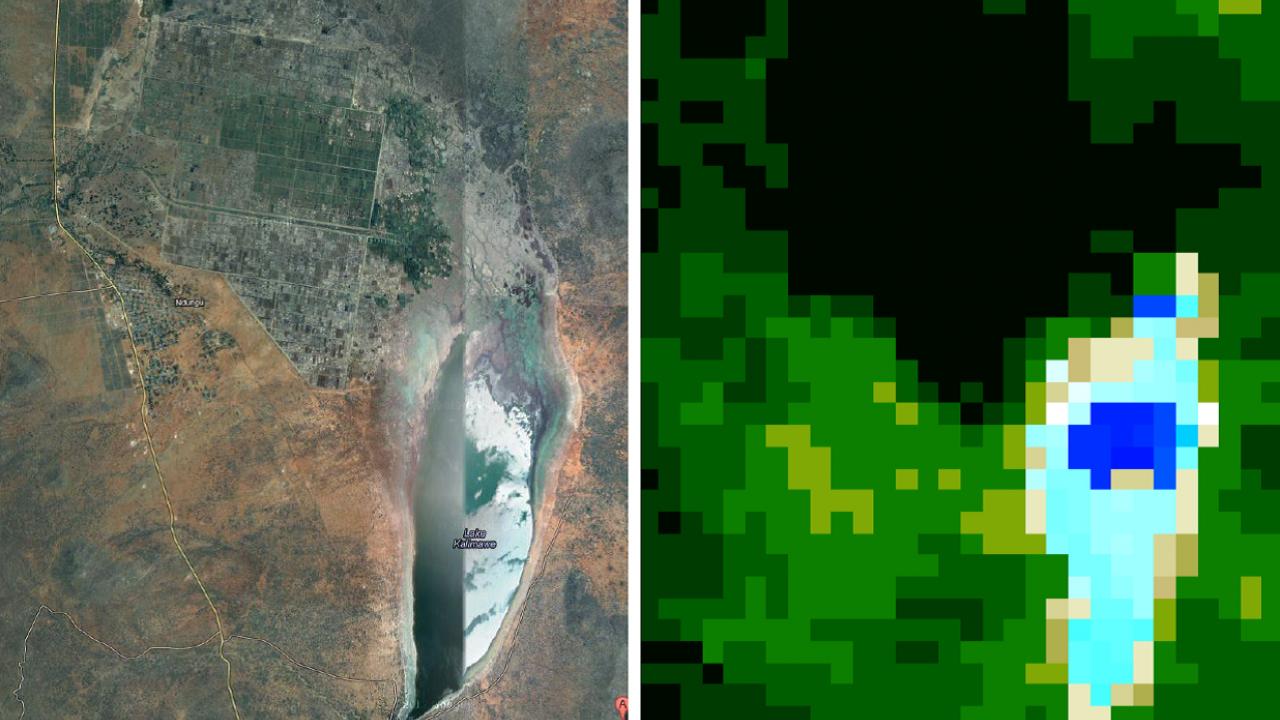

Insuring Seeds at Low Cost with NDVI

The image on the left is a true-color composite image taken by satellite over northeast Tanzania. On the right is the same location represented in 250m pixels that average the amount of infrared and near-infrared light reflected back from vegetation on the ground. This measurement of NDVI can be used to build an index for insurance that accurately predicts average crop losses in an area.

The index insurance for this RCT, which added 20 percent to the cost of DTM seeds, provided in-kind payouts of DTM seed packets in the season following severe losses as estimated by two separate indices. These indices were designed to complement the biological, mid-season drought tolerance of the DTM seeds.

The first index triggered payouts if rainfall during the first 40 days of the season was below 80mm. The second index triggered payouts if yield estimate based on a combination of a satellite measure of NDVI and full-season cumulative rainfall fell below 60 percent of normal.

We determined the levels of both triggers using historical data on yield losses we collected directly from 40 farmers in each of the 36 insurance zones where we would conduct the RCT. While historical yields based on recall can be imprecise, comparing that information to historical weather and NDVI data let us estimate how likely our index insurance product would pay out accurately when farmers had real losses.

Fail-safe Audit

The index insurance bundled with DTM included a fail-safe audit option so farmers who purchased the insured DTM seeds could verify that the insurance worked as it should in the event of losses. For the two seasons insured DTM seeds were made available, farmers made no audit requests.

A field audit, conducted by an agronomist, would estimate the average yields in an area using crop cuttings. These audits are expensive and time consuming, increasing the cost of the insurance and delaying any payouts due.

To reduce these potential costs in the RCT, CIMMYT implemented a method using photographs of maize cobs to accurately estimate average yields in an area. This method could both reduce the costs of an audit and reduce the amount of time needed to get payments to farmers who have suffered a loss.

The insurance also came with a fail-safe audit rule, so if 30 percent of insured farmers requested it, the insurance company would be required to hire an agronomist to conduct a crop cutting to verify the insurance had paid out as it should. We estimated that an audit would be necessary for no more than 13 percent of severe loss events. While an audit would be costly, we believed that the rule would sustain farmers’ confidence in the insurance and free them to increase their investments in productivity.

The dual-trigger index performed as designed in both Mozambique and Tanzania. In Mozambique, in-kind payouts only triggered during the second year for shortfalls in early season rainfall in two communities. Five households received a total of 43 kg of replaced seed. In Tanzania, for the 2016-2017 growing season, drought triggered in-kind payouts of 1,220 bags of seed. After drought in the following season, local vendors replaced another 186 bags of seed.

Promoting Adoption

For farmers to adopt a new technology, whether drought-tolerant seeds or index insurance, they have to trust it will benefit them far beyond its cost. Even if a drought technology can guarantee perfect protection, drought does not come every season. Farmers could wait years before learning first-hand if their trust in potential benefits was well-placed or only a wasted expense.

For farmers who have never tried drought-tolerant seeds, their expectations of its benefits and the risks they face may play a significant role in the decision to adopt it. A model[1] of survey data from this RCT showed that farmers who had a higher expectation DTM yields or a lower expectation of the coming season’s rainfall were both more likely to adopt the seeds. These effects were strongest among households who produce the lowest yields.

Farmers’ beliefs about their control over yields also may play a role in whether they adopt a technology that safeguards those yields. This could be particularly true for small-scale farmers who face a high risk of various shocks, from conflict to cyclones, in addition to drought. An analysis[2] of the RCT survey data from Mozambique showed that households who believed they had the least amount of control over maize yields were about 5 percent less likely to adopt DTM seeds with or without insurance.

A drought-tolerant technology like DTM in itself presents a unique learning challenge for farmers. While DTM can withstand a moderate mid-season drought, its yield benefits decrease the more severe a drought becomes. A 2010 study[3] using a learning and diffusion model showed that widespread adoption of new varieties only takes place when the yield benefits stand out against variations in climate, rainfall and other factors that also affect yields.

As with DTM, it could be years before farmers learn first-hand the benefits of insurance, but unlike DTM a cash or in-kind payout are definitive. In the RCT, farmers who received in-kind payouts chose to increase their investments in maize after a severe shock.

[1] Paul, L. 2019. “Drought-Tolerant Maize in East Africa: Crop Resilience, Yield Gap, and Farmers’ Adoption Decisions.” Ph.D. Dissertation. UC Davis Department of Agricultural and Resource Economics.

[2] Malacarne, J. 2019. “The Farmer and The Fates: Locus of Control and Investment in Rainfed Agriculture.” Ph.D. Dissertation. UC Davis Department of Agricultural and Resource Economics.

[3] Lybbert, T., A. Bell. 2010. “Stochastic Benefit Streams, Learning, and Technology Diffusion: Why Drought Tolerance Is Not the New Bt.” AgBioForum.

Resilience Two Ways

Two key ideas at the center of this RCT were that seed and financial technologies both have the potential to stabilize yields and incomes in the event of drought but also that they can reduce risk enough that farmers will invest more in higher productivity. The two technologies expand each other’s benefits: the drought-tolerance of the seeds reduces the cost of the insurance while the insurance reduces the risk of adopting the seeds and extends their overall drought protection.

In the RCT in Mozambique and Tanzania, DTM bundled with index insurance promoted resilience two ways: DTM itself maintained yields during a moderate mid-season drought and the in-kind insurance payouts allowed farmers to more than recover following severe drought. These results stand in sharp contrast to the experience of control-group farmers who suffered long-term effects from losses. Even a year after these severe losses, control-group farmers were unable to recover.

Control-group farmers had low levels of productivity that were very sensitive to drought. In moderate mid-season droughts, their maize yields declined by about 15 percent, and in severe droughts their maize yields declined by 40 percent. While control-group farmers were generally able to recover from moderate shocks, they were unable to recover from severe shocks.

The impacts of severe drought on control-group farmers were significant and lasting. We observe a lack of recovery in subsequent estimates of food insecurity following mid-season and severe droughts. Using the HFIAS food insecurity scale, we estimate that food insecurity increased 12 percent following mid-season droughts and 45 percent following severe droughts.

We can also see a lack of recovery in how much improved seeds of any kind they used after a severe shock. The purchase of improved seeds represent a farmer’s capitalization since these seeds are a bigger cash investment than local, saved seeds. Control-group farmers who experienced a yield shock subsequently reduced their use of improved seeds from an average of 19.4 kg to 13.1 kg. This sharp decline indicates a sudden decapitalization among farmers who experienced severe losses.

Resilience+

In emerging economies, disasters like drought, flood or conflict make people poor. The potential for disasters often also keeps people poor by adding insurmountable risk to adopting development innovations like stress-tolerant seeds, or low-cost loans.

Reducing the risk of disasters can create opportunities for families to adopt more productive technologies like drought-tolerant seeds. These technologies can promote resilience, which USAID defines as the capacity to anticipate, prepare for and recover from shocks and stressors.

MRR Innovation Lab researchers and others have shown that the resulting increases in food and income can also keep people from falling into poverty while building a ladder up for families who are already poor—that’s Resilience+.

By contrast, farmers in the DT and DTII groups both had higher yields in years with normal rainfall and stabilized yields during mid-season droughts. The yield advantage of DTM seeds in years with normal rainfall was about 12 percent. That advantage increased to nearly 50 percent in years with mid-season drought, completely offsetting the losses of farmers in the control group. While the evidence is less precise, DTM also appears to have offset increases in food insecurity following mid-season droughts.

In a severe drought, DTM yields also fell precipitously, confirming that while the seeds are drought-tolerant they are not drought-proof. But, in the wake of these severe shocks, farmers with insured seeds more than fully recovered and even achieved higher yields than in the year before the shock.

Farmers in the DT and DTII groups both increased their use of improved seeds after a drought but to very different degrees. Farmers in the DT group increased their use of improved seeds from 27.2 kg to 29.8 kg. Farmers in the DTII group increased their use of improved seeds from 28.1 kg to 49.8 kg. This striking increase among DTII farmers indicates that the first-hand experience of the in-kind payouts encouraged them to deepen their investments in maize production.

In sum, DTM promotes resilience to moderate mid-season drought, but bundling it with insurance promotes Resilience+ in seasons after farmers suffer significant losses. As seeds are a primary form of capital for many small-scale farmers, this paired intervention can transform how families recover from a shock like drought in areas where food security is driven by rain-fed agriculture.

Steve Boucher is a professor of agricultural and resource economics at UC Davis.

Michael Carter is a professor of agricultural and resource economics at UC Davis and director of the MRR Innovation Lab.

Olaf Erenstein is the director of the socioeconomics program at CIMMYT.

Travis Lybbert is a professor of agricultural and resource economics at UC Davis.

Jonathan Malacarne an assistant professor of economics at the University of Maine.

Paswel Marenya is a senior economist with the socioeconomics program at CIMMYT.

Laura Paul is a postdoctoral researcher at the University of Delaware.

This project was funded by USAID Associate Award No. AID-OAALA-15-00002. This report is made possible by the generous support of the American people through the United States Agency for International Development (USAID) cooperative agreement 7200AA19LE00004. The contents are the responsibility of the Feed the Future Innovation Lab for Markets, Risk & Resilience and do not necessarily reflect the views of USAID or the United States Government.