Index insurance has shown great promise in helping poor and vulnerable farmers to manage the risks associated with climate-related disasters like drought and flood. Index insurance works for development because it avoids the high costs and logistical challenges of offering conventional insurance in developing agricultural economies.

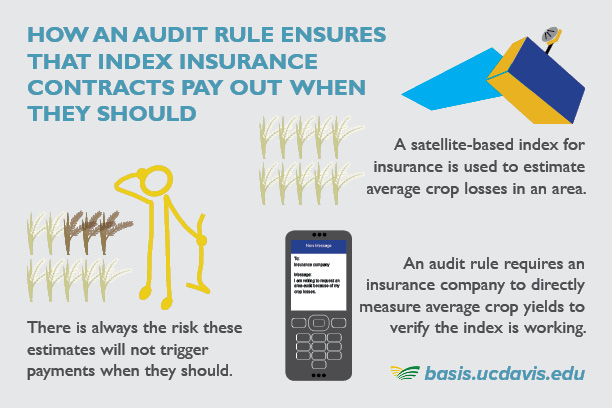

However, even the highest quality index insurance products carry the risk of failing to pay when farmers experience losses. This is because index insurance links payouts to outside factors, such as levels of rainfall, vegetation growth or an area’s average crop yields rather verified individual claims. An index of these factors predicts average losses in an area, not individual losses.

However, even the highest quality index insurance products carry the risk of failing to pay when farmers experience losses. This is because index insurance links payouts to outside factors, such as levels of rainfall, vegetation growth or an area’s average crop yields rather verified individual claims. An index of these factors predicts average losses in an area, not individual losses.

For this reason, index insurance will always carry basis risk, meaning a chance that the predicted losses do not match up with real losses on the ground. To minimize the risk that an index insurance contract will fail to pay out in the case of unpredicted but widespread losses, AMA Innovation Lab researchers are testing an audit rule so farmers can be sure their index insurance product has functioned as it should.

An Audit Rule Is an Index Insurance Failsafe for Farmers

An audit rule provides a failsafe for farmers if an index insurance product fails to trigger payouts when it should. It combines the potential for the accuracy of direct measurements of average yields with the lower costs of an index built from remote measures of vegetation cover or weather data.

Area-based yield index insurance, which is based on the average yield of all producers in an area, is the most reliable type of index insurance. However, in practice area yield measurements are very expensive. They are typically only possible without high additional costs in supply chains with a single buyer or where governments already regularly collect data on agricultural yields.

For farmers with index insurance products based on remotely measured outside factors like rainfall or vegetation cover, an audit rule gives them the right to petition their insurance company to have an agronomist measure average village yields if the index fails to trigger payments despite losses on the ground. It functions as a failsafe so farmers can be secure that they will receive payouts when they are most needed.

An audit rule should ensure that index insurance contracts based on remotely measured data offer the same protection as contracts based on area-yield measurements. However, to be cost effective, the underlying index of those contracts must be reliable. Otherwise expensive audits triggered too frequently can make the product cost more to an insurance company than farmers will pay in premiums.

Audit Rule Pilot Project in Tanzania

A recent AMA Innovation Lab pilot project in Tanzania demonstrated the importance of an audit rule even with a product based on the most accurate index possible. The research team based the insurance contract on a combined index of historical rainfall and vegetation growth data, which they then compared against average village crop yields going back up to ten years.

The contract would trigger payments when estimated yields fell below 60 percent of their historical average. The audit rule allowed farmers to send the insurance company a text message if payments did not trigger but they believed yields in the area are below 60 percent of normal. If more than 30 percent of farmers registered a complaint, the company would be bound to carry out an audit for verification.

Despite the overall strong performance of this combined index, the research team estimated it would still fail to trigger for severe losses 13 percent of the time. This failure rate highlights the imperfection of even this multi-index insurance contract and the importance of the fail-safe audit option so farmers can be confident in the product.

An Audit Rule as Part of a Safe Minimum Standard (SMS)

Contracts that fail to pay when they should can have serious consequences for a farmer without the recourse of a mechanism like an audit rule. An audit rule can provide added security farmers require to invest their limited funds in a more productive future.

Even the highest-quality index insurance contracts can fail, and this bais risk is one reason why the widespread adoption of index insurance among small-scale farmers remains low. To help encourage the wider adoption of index insurance in developing economies, we must consider mechanisms like an audit rule that build trust in the products and provide security for vulnerable farmers.

As index insurance products remain unregulated, the development and enforcement of a Safe Minimum Standard (SMS) for quality could prevent the sale of low-quality, risk-laden contracts that create distrust among farmers and undercut the market. An audit rule can be a core part of these standards to ensure that these products function as they should, even as the indices upon which they are built continue to improve.