Multiple factors constrain the development of an inclusive, sustainable agricultural insurance market. Household insurance decisions tend to be dominated by men, who commonly manage the financial transactions around agriculture. Low understandings of insurance are common; people are often unfamiliar with both how insurance works as well as the companies that sell it. Moreover, farming households may experience difficulty in affording premiums—including limited liquidity at certain times of year and/or with little notice of an agent’s visit. Lastly, high transaction costs characterize agricultural insurance sales, as rural areas are time-consuming and expensive for agents to reach, while the value of individual transactions are small.

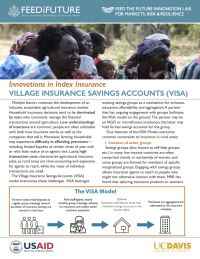

The Village Insurance Savings Accounts (VISA) model overcomes these challenges. VISA leverages existing savings groups as a mechanism for inclusion, education, affordability and aggregation. A partner that has ongoing engagement with groups facilitates the VISA model on the ground. The partner may be an NGO or microfinance institution; the latter may hold formal savings accounts for the group.

Four features of the VISA Model overcome common constraints to insurance in rural areas:

1. Inclusion of other groups

Savings groups (also known as self-help groups, etc.) in many low-income countries are often comprised mostly or exclusively of women, and some groups are formed for members of specific marginalized groups. Engaging with savings groups allows insurance agents to reach to people who might not otherwise interact with them. MRR has found that tailoring insurance products to women’s needs also increases uptake.1.

2. Understanding via education Rather than listening to an unknown insurance agent give an insurance sales-pitch, participants learn about insurance from a known outreach staff, who is not pursuing commissions from their purchase, but rather wants to help members make the best decision for themselves. The outreach worker uses learning tools like comic books to build understanding of insurance across multiple group meetings.

3. Affordability through saving Group members interested in buying insurance are encouraged to make regular savings deposits specifically for paying for the premium. Shifting the insurance premium from a single, large expense to recurring, smaller payments makes it easier for many people to afford. It also allows people time to consider whether to buy insurance, rather than requiring an instant decision when an insurance agent visits. (Under VISA, insurance savings can be withdrawn and re-purposed at any time before the premium is purchased.)

4. Lower costs with aggregation Reaching groups of people through partner outreach dramatically reduces the marginal (per-unit) transaction costs for insurance companies. Realizing these lower costs can then incentivize insurance companies to develop products targeted to the needs of small-scale agricultural households.

VISA in Action: Northern Kenya

MRR researchers have supported the design and development of Index-Based Livestock Insurance (IBLI) since its inception in the Horn of Africa. Based on satellite measures of vegetation levels, IBLI has proven to be an effective way for pastoralist households to manage their drought risk. However, because men control the family’s livestock and the insurance payments for losses, women did not engage with insurance—though they are also exposed to risk.

MRR worked with Takaful Insurance of Africa to reformulate IBLI into gender-inclusive insurance, which retains the drought payout trigger but insures “family units” instead of heads of livestock. Staff of the NGO, BOMA introduced the gender-inclusive insurance to the women. MRR found that the gender-inclusive framing increased insurance uptake by approximately 10 percentage points when households previously used subsidies to try the insurance.

The Village Insurance Savings Account (VISA) Model is now scaling the gender-inclusive insurance without subsidy. BOMA is the outreach partner; its field staff engage with savings groups comprised with graduates of their Rural Entrepreneur Access Program. Group members can set up an insurance savings account within the group accounting structure. Saving about $3/month for five months allows women to purchase an insurance premium. As of 2024, 430 women’s savings groups are using VISA.

1Arteaga, J., Carter, M., Hobbs, A. 2024. “Insuring Those Who Bear the Risk: The Impact of Gender-Inclusive Insurance in Kenya.” WBER Working Paper 31639.