Pastoralist households in the arid and semi-arid areas of northern Kenya are especially vulnerable to the risk posed by climate change. As a result, households may avoid risky, but potentially high-return activities in favor of safer strategies, keeping them poorer than they need to be. When a drought occurs, households often cope with large losses by selling their remaining livestock, which could push the household into a poverty trap. Another common coping strategy is meal reduction, which leads to diminished household productivity as industrious household members weaken, and results in irreversible stunting in young children. These costly coping strategies contribute to the intergenerational transfer of poverty.

In January 2010, researchers supported by the Feed the Future Assets & Market Access Innovation Lab launched an IndexBased Livestock Insurance (IBLI) pilot in the Marsabit District of northern Kenya as an effort to improve the resilience of pastoralists in the face of frequent droughts. IBLI offers a payout based on an index rather than verification of individual losses (like conventional insurance), which would be prohibitively costly in these isolated and infrastructure deficient regions. The index used satellite-based measures of vegetative cover to predict livestock mortality, and it pays pastoralists for estimated livestock (cattle, camels, sheep, goats) deaths.

In January 2010, researchers supported by the Feed the Future Assets & Market Access Innovation Lab launched an IndexBased Livestock Insurance (IBLI) pilot in the Marsabit District of northern Kenya as an effort to improve the resilience of pastoralists in the face of frequent droughts. IBLI offers a payout based on an index rather than verification of individual losses (like conventional insurance), which would be prohibitively costly in these isolated and infrastructure deficient regions. The index used satellite-based measures of vegetative cover to predict livestock mortality, and it pays pastoralists for estimated livestock (cattle, camels, sheep, goats) deaths.

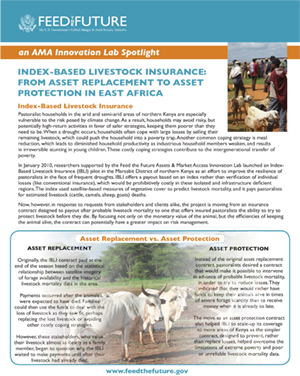

Now, however, in response to requests from stakeholders and clients alike, the project is moving from an insurance contract designed to payout after probable livestock mortality to one that offers insured pastoralists the ability to try to protect livestock before they die. By focusing not only on the monetary value of the animal, but the efficiencies of keeping the animal alive, the contract can potentially have a greater impact on risk management.

Why is this change important?

The change from an asset replacement to an asset protection contract was important for several reasons. First, it made contract design simpler and scaling-up much more feasible and efficient, allowing the IBLI program to develop contracts for all 14 Arid and Semi-Arid counties in Kenya relatively quickly. Program operations now cover 7 counties.

Second, this changed the unit of risk covered from the livestock itself to the estimated value of inputs needed to keep an animal alive in the event of a drought, and revised the potential payment schedule to just after the rainy season. This way, pastoralists receive funds in advance of a set threshold of expected mortality in order to purchase the water, fodder, and medicines that could help sustain their livestock.

Third, by shifting the insurance from a unit that could be compared to individual experience (mortality) to a unit that was visibly and jointly experienced (extreme forage shortage), it reduced the perceived “basis risk”. Target clients could more clearly understand the index’s conclusion by reducing easily observable differences between the index conclusion and their own experience (such as “the index said my cattle shouldn’t have died, but they did”).

How has the transition worked so far?

Thus far, the contract change has been well received by pastoralists. It is more easily understood, and has contributed to higher sales. However, as with any period of transition, there has been confusion related to payout schedules, total amounts of payout, etc. Given that this is the first experience of many with any form of insurance, there is a constant need for continuous and ongoing outreach and extension.

With regard to scaling-up, the asset protection contract has been adopted by the Government of Kenya under its Kenya Livestock Insurance Program (KLIP), which provides insurance for targeted individuals in Northern Kenya, with possible subsidies to the general public in the future. This is an important endorsement and up scaling of the IBLI product that can be partly credited to this transition from asset replacement to asset protection. A similar program in Ethiopia has also moved to the asset protection contract, as stakeholders and clients alike prefer early intervention for asset protection.

What are the prospects for the future?

Already, the asset protection contract has been very well accepted. Pastoralists, their leadership, and the insurance companies offering the product all seem to have a strong preference for intervening before livestock loss.

The fact that an asset protection contract is much easier to design and scale is likely to make it more attractive to insurance companies and, again, help catalyze expansion, transferring risk across an expanded geographical area.

Nevertheless, one key challenge persists. The logic of an asset protection contract necessitates the presence of markets where pastoralists can access the inputs required to keep emaciated livestock alive. However, in reality, markets for feeds, water, and veterinary drugs are often quite thin or nonexistent in pastoralist areas. For these contracts to have greater impact, efforts are needed to develop such markets and ensure accessibility for pastoralists.

This report is made possible by the generous support of the American people through the United States Agency for International Development (USAID). The contents are the responsibility of the Feed the Future Innovation Lab for Assets and Market Access at UC Davis and do not necessarily reflect the views of USAID or the United States Government.