Serious illness and injury typically simultaneously increase medical expenditures and reduce a family's income. Although poor households often forego highvalue care, they frequently pay substantial sums for low quality care. Thus a short-term health shock with costly health care can lead to a long-term increase in poverty through increased debt, asset sales, and termination of children's education. Health insurance is intended to reduce such economic difficulties following illness or injury. It may also increase access to health care, thereby improving health outcomes, especially if it reaches a poor population that often foregoes care due to cost.

Unfortunately, rigorous evidence on the impact of health insurance is scarce, especially in developing countries. This lack of evidence occurs partly due to the nature of voluntary insurance. Iuch and well-educated households typically have both better health and superior health insurance coverage. Importantly, that correlation does not mean insurance improves health. At the same time, those experiencing poor health may be more likely to purchase health insurance when it is offered, but again that relationship does not mean insurance worsens health.

Unfortunately, rigorous evidence on the impact of health insurance is scarce, especially in developing countries. This lack of evidence occurs partly due to the nature of voluntary insurance. Iuch and well-educated households typically have both better health and superior health insurance coverage. Importantly, that correlation does not mean insurance improves health. At the same time, those experiencing poor health may be more likely to purchase health insurance when it is offered, but again that relationship does not mean insurance worsens health.

The Evaluation

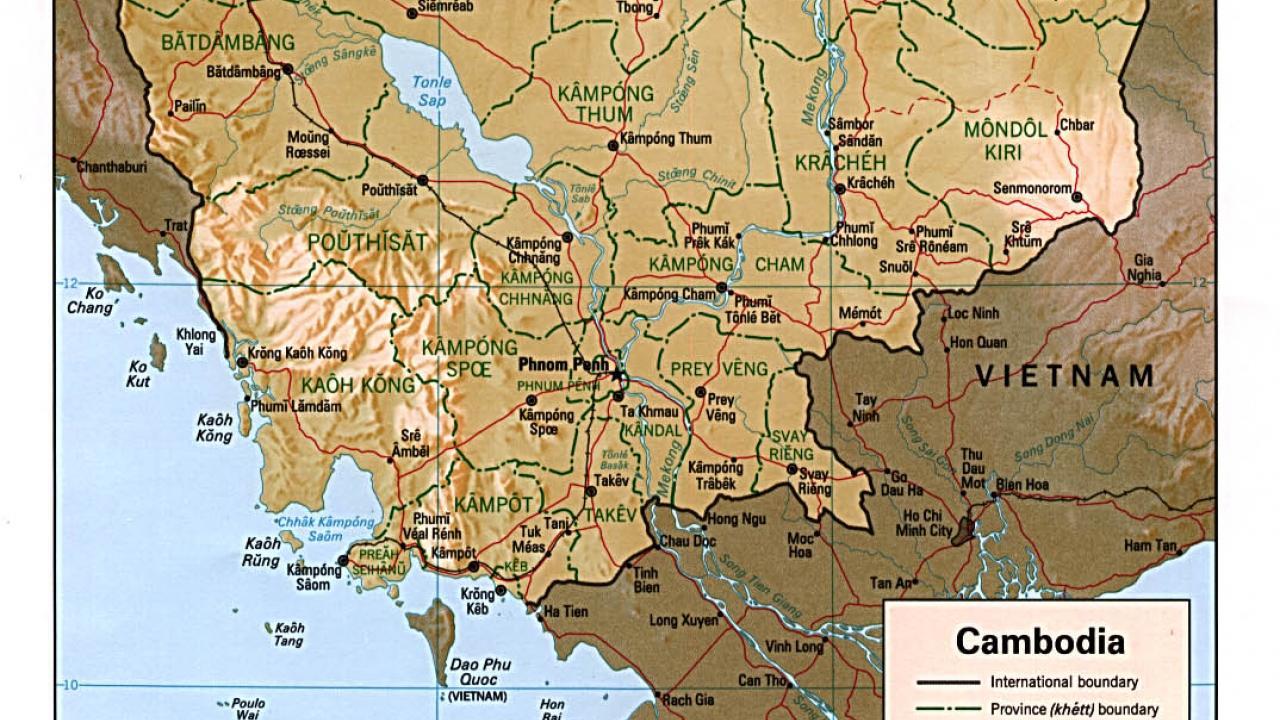

Cambodia is one of the world's poorest and least BASIS Brief healthy nations. Cambodians rely on a mix of public healthcare providers, private medical providers, private drug sellers (largely without pharmaceutical training), and traditional healers. Public facilities consist of local health centers, which provide basic care for everyday illnesses, Operational District Referral Hospitals, for illnesses requiring more involved treatment, and Provincial Hospitals, for care of more severe health shocks.

Public facilities are subsidized by the Cambodian government and, in some cases, other organizations. Yet, public facilities have low utilization. Private providers of varying capabilities are typically more popular than public ones, even when more expensive, because they are generally more attentive to clients' needs, more available, visit patients in their homes, provide treatments patients prefer, and offer credit.

Since 1998 the French NGO GRET has been experimenting with micro-insurance schemes by examining responses to various premiums and benefits of their SKY insurance. SKY's goal is to reduce the negative economic consequences of healths shocks, while at the same time increase utilization of regulated public care and, in the long term, improve health outcomes.

Historically, take-up of insurance has ranged from 2 percent in regions where it has recently been introduced to 12 percent in the longest-served regions. While the SKY program targets the poor, it also is trying to avoid financial losses and operate without donor support in the long term. Thus, the policy includes several terms that limit adverse selection. For example, SKY does not pay for the delivery of babies within the first few months of joining. SKY also requires a household-level purchase, eliminating the possibility that households would obtain insurance only for very ill or frail members.

Finally, SKY insurance does not cover care of chronic diseases such as diabetes (though government programs pay for the very expensive drugs needed for HIV/AIDS and tuberculosis). In 2007, when this study began, SKY sold insurance at prices ranging from $0.50 per month for a single-person household to around $2.75 per month for a household with eight or more members. Households sign up for six months, paying for the first month's coverage plus two reserve months up front. While a household can stop insurance payments at any time, failing to pay two consecutive months before the end of the six-month cycle results in the loss of one month of reserve. Insured household members are entitled to free services and prescribed drugs at local public health centers and at public hospitals with a referral.

When the SKY program first rolls out into a region, SKY holds a village meeting to describe the insurance product to prospective customers. Researchers took advantage of the rollout structure to set up a project that would allow them to gain key insights into the take up and utilization of insurance. To randomize the price of insurance, a Lucky Draw lottery was held.

Winners of the Lucky Draw received a deeply discounted price: four extra months discount in the first 6-month cycle, take-up that allows us to estimate how health insurance affects health care utilization and the economic costs of serious illnesses or injuries. Our experiment was carried out as the SKY program expanded to 245 villages from November 2007 to December 2008 in the rural provinces of Takeo, Kandal, and Kampot.

Our randomization was successful in that 50 percent of those offered a deep discount purchased SKY for at least some of the following year, which was far higher than the 5 percent rate for among those who were offered the normal price. The effects for "SKY members" presented below refers to the effect of SKY membership on those who joined SKY due to the deep discount (not to the small number in our control group who joined SKY even at full price).

We surveyed over 5,000 households, half of whom won the Lucky Draw lottery and were offered the steeply discounted price and the other half of whom were offered the regular price. To evaluate the impact of SKY insurance on both health and wealth we rely largely on a follow-up survey, which took place 13 to 20 months after the initial SKY marketing meetings. We also use some data from a survey administered one to eight months after the village meetings.

Does Health Seeking Behavior Change?

What happens to households after a serious health incident? After purchasing insurance do they seek care more rapidly and from more reliable sources? Does their overall health improve due to increased usage of preventative care?

We hypothesized SKY would speed access to health care. In fact, most people get care the first day of a serious problem (seven or more days unable to perform usual activities or resulting in a death), but the care is from a private doctor or a local drug-seller. If we look at the time it takes to get care from a public hospital or a private clinic, SKY does not reduce delays. However, SKY members are more than twice as likely to first seek treatment (see Figure 1) from a public health center (32% for SKY members vs. 14% for controls). In addition, rates of accessing private providers (36% vs. 47%) and of drug sellers are correspondingly lower (6% vs. 14%). There was a similar increase in use of public care when we look at whether the household ever used public care for a serious incident.

SKY hoped increased use of public facilities would also increase and improve preventative care. The results on preventive care are not very precise because of the smaller sample size of children (for immunization measures) and women of reproductive age (for birth outcomes and contraception). With that caution in mind, there is no detectable effect on the proportion of children whose immunizations are up to date, the share of married women ages 16-45 using contraception or the share of attended births.

Those who purchased insurance due to the discount had a 3 .2 percentage point reduction in discontinued treatment due to cost following a health incident compared to the uninsured mean of 5.2 percent. Though large, this difference is not statistically significant at conventional levels.

When we designed this study we knew it covered too short a time period to measure the improvements in health we thought were likely to arise from insurance coverage. Nevertheless, we measured health several ways: mortality rates, the number of incidents that disabled someone for seven or more days, and children's nutritional status (BMI and height-for-age). As expected, SKY insurance had no detectable effect on any of these measures.

Does SKY preserve household wealth?

A serious health incident led to an average of $104 in health care costs for the uninsured, and about half as much for the insured. The reduction in the average cost is largely due to fewer expensive incidents. While 11 percent of incidents in control households had health care costs of over $250, insurance decreased this percentage by 8.6 percentage points. Results are similar, but less precise, when we cumulate all incidents in a household in a year: insured households have 5.0 percentage points lower probability of spending over $350 compared to the uninsured's rate of 11.5 percent, and 10.9 percentage points lower probability of spending over $100 following a shock compared to 38.2 percent for the uninsured.

When we asked how families paid for major health shocks, SKY households are 9.2 percentage points less likely to sell assets following a shock, 13.6 percentage points less likely to take out a loan with interest, and 6.4 percentage points less likely to take out a loan without interest, following a large health shock (see Fig. 2).

Consistent with insurance reducing out-of-pocket expenditures, households with SKY also have less debt. On average, insured households have $68 lower debt, about one third less than the mean among uninsured households.

The insured are less likely to report a reduction in land from the previous year, though the estimate is not statistically significant. If we focus specifically on sales of land that the respondent said was due to high health care costs, 1 % of non-SKY members, but no SKY members, said high health care costs led to the land sale.

Promising but Limited

SKY has been successful in reaching its first goal of shifting rural Cambodians from unregulated private providers and drug sellers to the public health care system. However, we did not find evidence of success on other goals related to health care. There was no reduction in delays prior to receiving care. Preventive care such as immunizations and prenatal care also did not increase as SKY had hoped due to higher exposure to health messages at public health centers.

SKY health insurance did, however, protect against economic loss. SKY reduced total medical expenses following a major health shock primarily due to lower rates oflarge expenses. SKY households also had lower accumulation of debt as a result of health problems, and were less likely to sell productive assets or land to pay for care following a large health shock.

Our results suggest that most uninsured households will probably take on debt to pay for health care at some point in their lives. A substantial minority of those households will also sell productive assets such as land. SKY health insurance cuts the rates of these events by about a third.

In short, SKY insurance is achieving some, but not all, of its objectives. While encouraging in some regards, this study examines one insurer operating in a few regions of a single nation. We need more studies that rigorously evaluate microinsurance and other innovations in health care financing. The low take-up of voluntary health insurance emphasizes the importance of other existing and potential programs that increase access to health care for the rural poor.

Further reading

Mathieu Noirhomme, Bruno Meessen, Fred Griffiths, Por Ir, Bart Jacobs, Rasoka Thor, Bart Criel and Wim Van Damme. "Improving access to hospital care for the poor: comparative analysis of four health equity funds in Cambodia" Health Policy Plan. (2007) 22 (4): 246-262.

Levine, David I., Rachel Polimeni and Ian Ramage. 2011. "Insuring Health or Insuring Wealth? An Experimental Evaluation