Resilience+ (also Resilience-Plus) describes when rural families are more immediately able to withstand a shock and when that knowledge increases their investment in agricultural productivity. This is how effective tools to manage risk not only protect current well-being and promote resilience, but also underwrite improvements in future well-being. Generating Resilience+ could accelerate efforts to reduce poverty and spur agricultural growth.

Key Points

- Many small-scale agricultural families face a significant risk of shocks like catastrophic drought or flood which make them poor but also keep them poor by constraining their investments in higher productivity.

- Resilience+ is when rural families are more immediately able to withstand a shock and when that knowledge spurs their investment in agricultural growth.

- Field evidence from Mali, Kenya, Bangladesh and other countries show that tools to manage weather-related risks do encourage rural families to invest for higher future incomes.

- Learning, experience and trust with better tools for risk management are critical for driving investments that generate Resilience+.

- Any program that families know will reliably and predictably protect them against disasters might induce investments that generate Resilience+.

For the 800 million people who go to bed hungry every night and many more at risk of extreme poverty, a single drought, flood of other disaster could wipe out the means they have to feed themselves. For agricultural families, even a risk of these disasters can create hardship. A family’s future can depend on the tools they have to manage these risks.

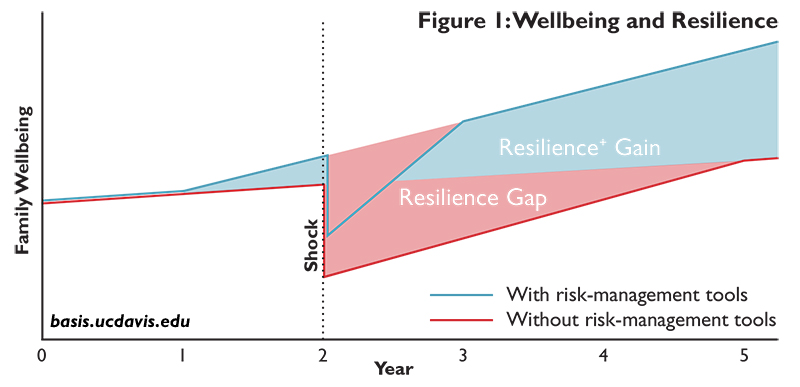

For a family without effective tools to manage risk, a disaster can create immediate hardship as well as lingering effects. The family may have to choose what assets to sell or who eats and how much. The shock may also damage psychological capacities,[1] further undercutting their economic wellbeing. As shown in Figure 1, the accumulating losses caused by a shock—a “resilience gap”—illustrate the long-term costs of shocks and a lack of resilience. When a disaster compromises their children’s development, the shock can also leave its mark across generations.[2]

In contrast, a family with reliable risk-management tools is likely to be resilient by the USAID definition of withstanding a shock with minimal damage to their current and future wellbeing. While this definition illustrates the potential of promoting resilience, it overlooks an additional benefit of managing risk.

Effective tools to manage risk shrink the resilience gap and position a family for higher income growth when those tools provide the security to invest in a new businesses or in more remunerative agricultural technologies. The full benefit of managing risk is not just shrinking the resilience gap, but also generating a positive resilience gain. Together, these two impacts build what we call Resilience+.

Definition of Resilience+

Resilience+ is the idea that reliable risk-management tools benefit families in two ways. First, families will be more immediately able to withstand a shock. Second, when a family knows they are protected they invest to improve their assets and income above where they began. This virtuous circle can become self-reinforcing.

Rural families in developing countries already do their best to manage risk. Families often shift their portfolio toward food and other necessities. They keep savings in the form of livestock, granaries or cash under the mattress, each of which carries significant risk of loss.

These strategies may keep a family from starvation but tie up cash that could be invested in improved seeds or veterinary services that increase income. This is how risk itself keeps a family poor. Better tools to manage risk open the door for Resilience+.

Evidence is encouraging that existing interventions can deliver Resilience+ through what I and other economists have referred to as the “risk-reduction dividend” and the “ex-ante” effect of risk reduction. Index insurance for cotton farmers in Mali[3] increased planting by between 25-40 percent. The resulting harvest would increase incomes by about US $300 on average, a benefit-cost ratio of 6.25.

In Kenya, Index-based Livestock Insurance (IBLI)[4] reduced the size of herds kept as a hedge against drought and increased milk production worth an average of $5.95 per month. When families no longer needed to manage their own risk with larger herds, they invested in veterinary care for the cows they had.

In Bangladesh, a BRAC emergency loan[5] conveyed all the benefits of insurance but without the up-front cost. Families told they would have the loan planted about 25 percent more rice than households not offered the loan. Families who did not suffer any flood losses produced about 33 percent more rice.

A project in Mozambique and Tanzania[6] bundled CIMMYT drought-tolerant maize with index insurance for a seed-replacement guarantee. Farmers who purchased insured seeds had 12 percent higher yields in normal years. After severe drought and seed replacements, farmers nearly doubled their investments in improved seeds.

Generating Resilience+

Learning, experience and trust are critical for generating Resilience+. In Mozambique and Tanzania, farmers had to experience that the insurance would actually work as promised before they were willing to risk investing more in improved seeds. Alternatively, emergency food aid might keep a disaster from compromising a family’s current and future wellbeing but it does not come with the predictability a family needs to risk investing for higher incomes.

Any program that a family knows will reliably and predictably protect them against disasters might induce investments that generate Resilience+. Even a savings account could generate Resilience+ if the interest itself is sufficient to make investments in higher productivity. Adding a mix of savings and credit to low-cost, high-quality insurance could further expand the overall opportunity to scale Resilience+.

While resilience to shocks and stressors is critical, the bigger opportunity is when a family can get on a path to higher income. This is the potential of Resilience+ and the reason we pursue risk management innovations to reduce poverty and spur agricultural growth.

Michael R. Carter is director of the MRR Innovation Lab and a professor of agricultural and resource economics at UC Davis.

1 Dean et al. 2019. “Poverty and Cognitive Function.” The Economics of Poverty Traps. U. of Chicago/NBER.

2 Barrett et al. 2019. “The Economics of Poverty Traps.” The Economics of Poverty Traps. U. of Chicago/NBER.

3 Elabed, G. et al. 2014. “Ex-ante Impacts of Agricultural Insurance: Evidence from a Field Experiment in Mali.” UC Davis ARE Working Paper.

4 Jensen, N. et al. 2016. “Cash transfers and index insurance: A comparative impact analysis from northern Kenya.” Journal of Development Economics.

5 Lane, G. 2018. “Borrowing for a rainy day: emergency loans in Bangladesh.” World Bank blog.

6 Boucher, S. et al. 2019. “Bundling Innovative Risk Management Technologies to Accelerate Agricultural Growth and Improve Nutrition.” AMA Innovation Lab.

This report is made possible by the generous support of the American people through the United States Agency for International Development (USAID) cooperative agreement 7200AA19LE00004. The contents are the responsibility of the Feed the Future Innovation Lab for Markets, Risk and Resilience and do not necessarily reflect the views of USAID or the United States Government.