Natural disasters create dire hardships for rural families in developing countries. National governments can pre-finance support with disaster risk insurance, but there has been no objective way to determine whether it is more effective than paying the costs as they arise. We developed tools to evaluate the case for disaster risk insurance and tested them with data from Kenya. With accurate national-level data, it is possible to evaluate disaster risk insurance and to build a metric for improving contract design.

Key Points

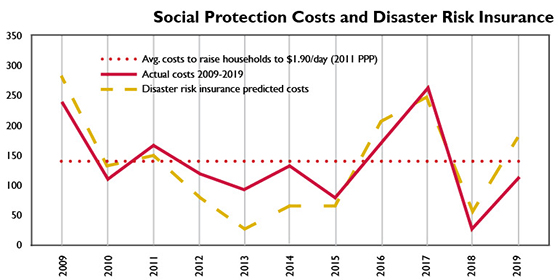

- The 2009-2019 cost to raise the all household incomes in Kenya’s arid and semi-arid lands to at least the $1.90/day (2011 PPP) poverty line averaged $140 million, though that cost ranged from year to year from $30 million to $266 million.

- Disaster risk insurance is a proactive approach to financing disaster-related social protection and has the benefits of responsiveness and budget stability.

- A representative insurance contract in Kenya would improve social welfare more effectively than having no insurance for the same fixed budget of $140 million.

- The economic costs of raising all incomes to a minimum of $1.90/day from 2009-2019 would have cost Kenya $434 million in foregone economic growth, while disaster risk insurance would have cut that loss by up to $250 million.

Climate-related disasters are key drivers of extreme poverty worldwide. The World Bank estimates that climate change will push up to 132 million people into extreme poverty by 2030.[1] A national government can support households driven into poverty, but the costs to do so may vary significantly from year to year.

About 80 percent of Kenya is arid or semi-arid, and in these largely rural areas severe drought can wipe out livelihoods for roughly five million people. According to the Kenya National Drought Management Agency (NDMA), the 2009-2019 average annual cost of keeping all people in these areas above the $1.90/day (2011 PPP) poverty line was about $140 million. The actual costs ranged from $30 million in 2018 to $266 million just the year before.

Disaster risk insurance, also called sovereign risk insurance, is a proactive approach to financing social protection. Disaster risk insurance is a form of index insurance, which triggers payments based on an index of factors that correlate with losses, such as vegetation growth or rainfall, rather than actual losses. Index insurance has lower costs and faster payments than traditional insurance but also has “basis risk,” which is the chance it will fail to pay accurately. In 2017, Malawi’s disaster risk insurance delayed payments when the index did not function as anticipated.[2]

There has been no objective framework for a government to decide whether to consider disaster risk insurance. We developed and tested such a framework as a case study with data from Kenya to show whether, with a fixed annual budget, disaster risk insurance generates greater social welfare and reduces foregone GDP growth compared to paying the full cost of supporting vulnerable families.

Welfare and Budget Volatility

In terms of welfare, our analysis tested whether disaster risk insurance would have benefited people in Kenya’s arid and semi-arid lands who were driven below the $1.90/day (2011 PPP) poverty line from 2009-2019 with a fixed annual government budget of $140 million. Our social welfare metric is a risk-adjusted income-per-day for people vulnerable to a disaster. By this metric, when losses are more extreme, the value of support and the harm of not providing it are greater. Direct payments from only the fixed $140 million budget without insurance yields a social welfare metric of $1.67 per vulnerable person.

We tested two types of insurance against this pay-as-you-go fixed budget scenario. The first contract is a hypothetical perfect insurance that perfectly matches actual costs. The second is a disaster risk insurance contract we designed to be as similar as possible to contracts currently available. Both contracts trigger payouts when the costs to raise all incomes to at least $1.90/day exceed the fixed annual budget of $140 million. The annual insurance premium cost for both contracts roughly equals the average of payouts from 2009-2019 plus a 20-percent markup.

Both types of insurance would raise the social welfare metric overall. Perfect insurance raises that metric to $1.80. The disaster risk insurance contract raises the metric to $1.75, though the contract would have overpaid in some years, increasing the cost of insurance premiums, and in other years would have underpaid, reducing needed funds.

Research on public finance[3] has found that budget volatility has an even bigger negative impact on long-term GDP than low levels of public investment. For example, a high, unexpected disaster-related cost may divert funding from infrastructure that jumpstarts or sustains economic growth. Based on statistical and econometric estimates from this literature, we found that disaster risk insurance would reduce the negative impacts of budget volatility. Paying the full 2009-2019 costs of raising incomes to $1.90/day would have reduced Kenya’s GDP by $434 million. A perfect insurance contract with a 10-percent markup would have reduced GDP by only $179 million. Our model index insurance contract, even with its failures, would have captured nearly all of those GDP-saving benefits.

Disaster Risk Insurance Quality

One key factor in whether disaster risk insurance is worthwhile is how accurately its index matches actual losses from year to year. To illustrate, if premiums cost $35 million and need is $266 million, as it was in Kenya in 2017, a perfect insurance contract would pay out $126 million. Added to the budget after premiums equals $231 million, which is less than what is needed but is also $91 million more than an annual budget of $140 million without insurance. However, if an actual disaster risk insurance contract failed to trigger payments at all, as nearly happened in Malawi in 2017, the government would have less than half of what was needed.

Rather than make a determination on disaster risk insurance for Kenya’s drylands, this case study illustrates a framework to conduct an objective analysis. With accurate national-level data on a disaster’s impact, it’s possible to test a disaster risk insurance contract to determine whether it provides the best means of supporting vulnerable citizens. It also provides a metric that can be used to improve the disaster risk insurance contract design.

Michael Carter is director of the Feed the Future Innovation Lab for Markets, Risk & Resilience and a distinguished professor of agricultural and resource economics at UC Davis.

[1] Arga Jafino, B., et al. 2020. “Revised Estimates of the Impact of Climate Change on Extreme Poverty by 2030.” World Bank.

[2] Tarazona, M., et al. 2017. “Independent Evaluation of the African Risk Capacity (ARC).” e-Pact.

[3] Museru, M., et al. 2014. “The Impact of Aid and Public Investment Volatility on Economic Growth in Sub-Saharan Africa.” World Development.

The research summarized in this report was commissioned by the International Livestock Research Institute. The production of this report was made possible by the generous support of the American people through the United States Agency for International Development (USAID) cooperative agreement 7200AA19LE00004. The contents are the responsibility of the Feed the Future Innovation Lab for Markets, Risk & Resilience and do not necessarily reflect the views of USAID or the United States Government.