Q&A: Agricultural Credit, Insurance, and Climate Change

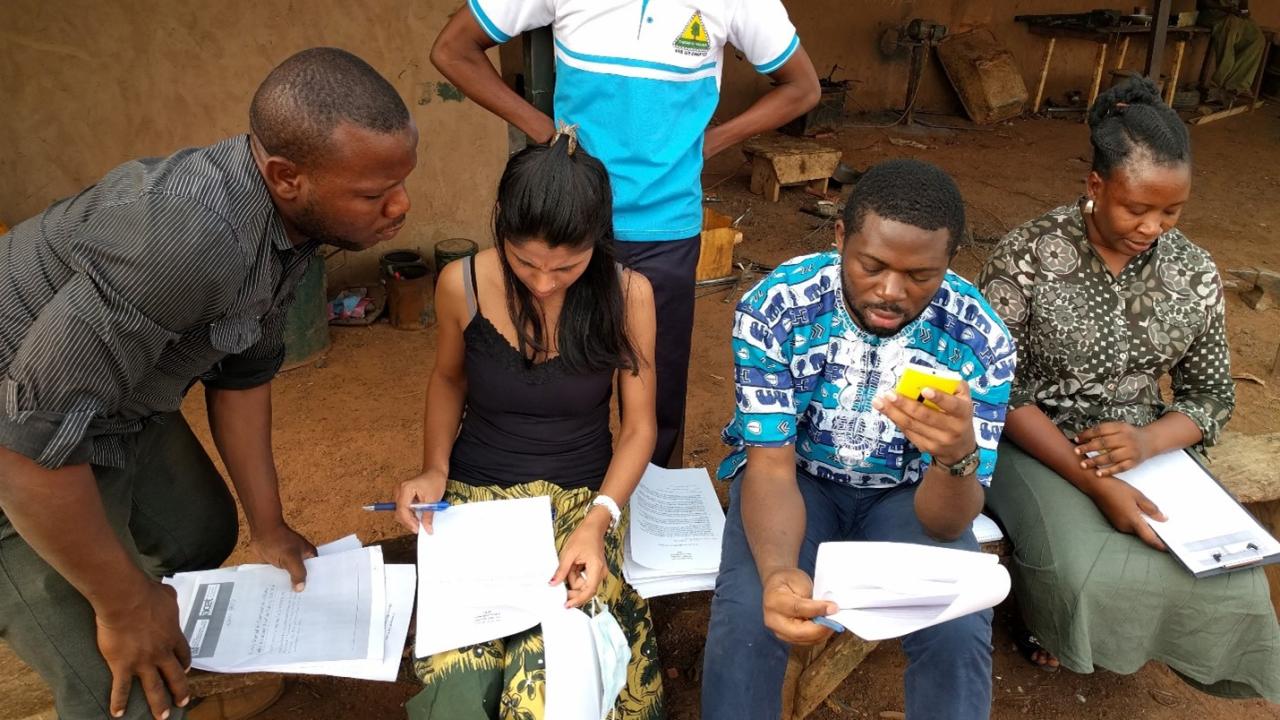

Khushbu Mishra, MRR Innovation Lab researcher and economist at Stetson University, recently published a paper on bundling insurance against drought with agricultural loans to encourage smallholder uptake of agricultural technology in northern Ghana.

In this Q&A, Mishra focuses on climate change – how farmers experience it, its implications for structuring agricultural insurance, and what it means for farmers’ attitudes toward risk.

In addition to the research in northern Ghana, Mishra’s roots in a Nepalese farming family and research in South Asia contribute to the picture she paints.

Uncertain weather has always made farming risky. How did Ghanaian farmers speak about climate change?

We heard over and over again how the rainfall pattern had been changing and how that was making it difficult for them to grow their primary crop of maize. They said that rainfall has been getting pushed back past their traditional time to sow, making it really hard to sow the seed. Not only that, but when the rain comes, it is no longer falling in a consistent manner like it did before. Sometimes it rains too much, sometimes less, so there’s not a good amount of rainfall for the growing season. And in northern Ghana, there is only one growing season for the whole year, so this makes their lives really difficult.

Most farmers grew up on their farms, and have memories going back decades of how the weather used to be different, before they were the primary farmer. They talk about how things have become worse since they started farming, and they are less satisfied with the crops they are growing.

I myself come from a farming family in Nepal – my grandfather and father are farmers – and I often hear my family talking about changing rainfall patterns. So unfortunately, climate change has negative impacts on them. If you’re dependent on rainfall and don’t have access to irrigation, your production is going to suffer.

Your paper noted that farmers may consider insurance against drought alone as inadequate risk protection, given other production hazards (e.g., pests and disease). As climate change expands farmers’ risk exposure, do you see multi-peril crop insurance as a promising solution?

For sure. Climate change doesn’t just bring different rainfall patterns, but also other types of extreme weather. In northern Ghana, as well as in South Asia where I’ve doing some work, summers have become hotter and hotter. As we know, a warmer climate attracts a lot of diseases – both for humans and for plants. So farmers are encountering higher levels of pests. I think multi-peril crop insurance is going to be very important.

No multi-peril crop insurance was available in northern Ghana at the time of our study; in fact, no agricultural insurance at all was available to these farmers until our project introduced it with the Ghanaian Agricultural Insurance Pool. Financial products are slower to come to northern Ghana, which is characterized by subsistence farming. More insurance options are available in southern Ghana, where farming is more advanced.

Among farmers in your sample, 72% described themselves either as “willing” or “very willing” to take risks. How do you think this bodes for a future in which they will see increasing impacts of climate change on agriculture?

Risk is a very interesting thing; it can go either way. Let’s say that you are a farmer with access to a new drought-resistant seed. Being a risk taker might mean that you are willing to experiment with new products, so you take a risk by planting with the new seed. Or, you might be willing to take a risk with the weather and not bother to try new products. So it’s hard to predict what a risk taker will do.

In general, we human beings tend to be wary of things that are new. Most people do not like change and don’t want to experiment with something new – especially if they’re the first ones. I don’t even like to go out to a restaurant without reading lots of reviews! Why would I expect a farmer in Northern Ghana to jump onto a new insurance product? That presents a much higher risk.

Do you have any other thoughts on climate change you would like to share?

Just a general thought on how interconnected we are. I think about this when I talk about these research papers with my class, as my students usually don’t think about how our actions can impact the lives of people on the other side of the world. And when you go to Ghana or Nepal and see these farmers dealing with all these challenges with climate change… they contribute the least to climate change, but they suffer the most because they don’t have a lot. Whatever they have comes from farming, and they lose that because people in developed countries consume so much that we are literally destroying the planet. It’s humbling and sad, and is always in the back of my mind.